Table of Contents

Top 10 Highest Currencies in the World.

Are you searching for top Highest currencies in the world? Some currencies are worth more than the others. Some are really expensive and others are way cheaper. In the world, there are popular currencies like the United States Dollars, Europe’s Euros and so on. But these currencies though they are very popular and widely used all over the world, are not the most expensive or the highest valued currencies in the world. There are other lesser-known currencies that you should be aware of and these lesser known currencies are also surprisingly very expensive. Here are the top highest currencies in Africa, check and clear some of your doubts.

Key Factors that Affect Currency Exchange Rates

Foreign currencies Exchange rate is one of the most significant and highly imperative avenue through which a country’s relative level of economic health is precisely determined. There is absolutely no doubt that a country’s foreign exchange rate provides a window to its economic stability, which is why it is continually been monitored and analyzed. If you are thinking of sending or receiving money from overseas, you need to keep a keen eye on the currency exchange rates.

A country’s currency value is a dependent variable on the foreign exchange level in the international market.Before considering in details the Highest Currencies in the World in 2019, lets consider few Key Factors that Affect Currency Exchange Rates. When considering the highest currencies in the world, this factors must be inevitably considered. Without any doubts, all of these factors determine the foreign exchange rate fluctuations. If you send or receive money frequently you must be very glad to know this highest currencies in the world, and being up-to-date on these factors will assist you better evaluate the optimal time for international money transfer.

1.Currency Inflation Rates

Like we all know inflation is the increase in the price of commodities both currencies and physical goods.The fluctuation in the market inflation can cause changes in foreign currency exchange rates. Practically, a country with a lower inflation rate than another’s will see an increase in the value of its currency. The prices of goods and services increase at a slower rate where the inflation is low.This will eventually affects the purchasing power of the country’s currency. Inflation is a quantitative measure of the rate at which the average price level of a selected goods and services in an economy increases over a period of time. Most times it is often expressed as a percentage, inflation in currencies can depict a decrease in the purchasing power of a nation’s currency. A country with a consistently lower inflation rate tends to posses a rising currency value while a country with higher inflation typically fights with depreciation in its currency value and is accompanied by higher interest bank and currencies rate.

2. Interest Rates

An interest rate is the amount of interest accumulated over a certain period, as a proportion of the amount collected, deposited or borrowed (called the principal sum). This is the rate a bank basically charges to borrow its money, or the rate a bank pays its savers for keeping money in an account. Based on the topic of focus, certain changes in interest rate affect currency value and dollar exchange rate. Forex rates, interest rates, and inflation are all correlated. Increases in interest rates results in a country’s currency to appreciate drastically due to higher interest rates which provide higher rates to lenders, thereby attracting more foreign capital, which causes a rise in exchange rates

3. Country’s Current Account / Balance of Payments

If a countries account balance is low, their currencies will be extremely low. The highest currencies in the world can be so little and negligible, but a higher country’s current account balance can normalize such statistics. A country’s current account reflects balance of trade and earnings on foreign exchanges and investment. It is basically made up of the total number of transactions including its exports, imports, debt, etc. A deficit in current account due to spending more of its currency on importing products than it is earning through sale of exports causes depreciation. It might also interest you to know that balance of payments fluctuates exchange rate of its domestic exchange currencies.

4. Government Debt

Government debt is public debt or national debt owned by the country’s central government.All nations are usually indebted in one way or the other. Honestly, any country with high rate of government debt is less likely to apply and subsequently acquire foreign capital, leading to massive inflation level or rate. Foreign investors will sell their bonds in the open market if the market predicts government debt within a certain country. As a result of this, a decrease in the value of its currency exchange rate will follow.

5. Highest currencies Terms of Trade

The Highest currencies terms of trade is the relative price of imports in terms of exports and it is the ratio of export prices to import prices. It can be interpreted as the amount of import goods an economy can purchase per unit of export goods. A country’s terms of trade improves if its exports currency prices rise at a greater rate than its imports prices. Positively, the product of this reaction is higher revenue, which causes a higher demand for the country’s currency and an increase in its currency’s value. This eventually results in an appreciation of exchange rate.

6. Political Stability & Performance

A country’s political state and economic performance can affect its currency strength. A country with less risk for political turmoil is more attractive to foreign investors, as a result, drawing investment away from other countries with more political and economic stability. Increase in foreign capital, in turn, leads to an appreciation in the value of its domestic currency. A country with sound financial and trade policy does not give any room for uncertainty in value of its currency. But, a country prone to political confusions may see a depreciation in exchange rates.

7. Recession

In economy, recession is a business cycle contraction when there is a general slowdown in economic activity.When a country experiences a recession, its interest rates are likely to fall, decreasing its chances to acquire foreign capital. As a result, its currency weakens in comparison to that of other countries, therefore lowering the exchange rate.

8. Speculation

Speculation is the act of conducting a financial transaction that has substantial risk of losing all value but with the expectation of a significant gain. With speculation, the risk of loss is more than offset by the possibility of a huge gain. If a country’s currency value is expected to rise, investors will demand more of that currency in order to make a profit in the near future. As a result, the value of the currency will rise due to the increase in demand. With this increase in currency value comes a rise in the exchange rate as well.

Top 10 Highest Currencies in the World.

Now, we will be looking at the top 10 highest currencies picked from all over the world that you should know. These currencies are from lesser known countries, for example Kuwait and they all make this epic list of ours. Follow us below to read more and to know more about them!

READ ALSO:Top 10 Best Currencies in Africa

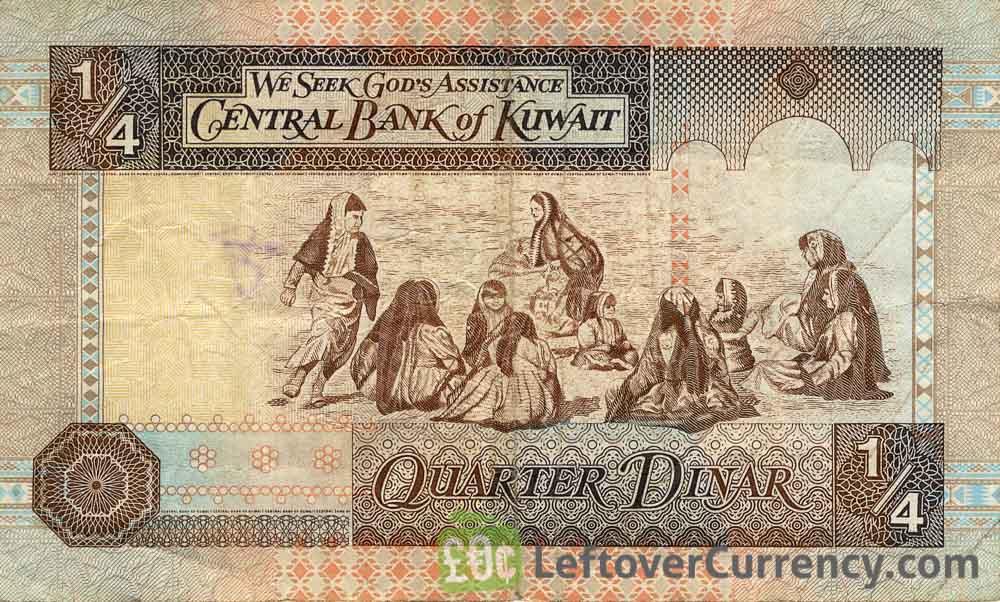

1. Kuwait Dinar

This currency is used in Kuwait. The Kuwait Dinar is the world’s highest currency in value. The currency is issued by the Central Bank of Kuwait. It exists in bank notes (1/4, 1/2, 1, 5, 10, 20 Dinars) and in coins (1, 5, 10, 20, 50, 100 Fils). One Kuwait Dinar equals to 3.29 US Dollars and ₦1,190 in Nigerian Naira.

2. Bahraini Dinar

This is the official currency of Bahrain, an island country located near Saudi Arabia. Honestly, I am not surprised this currency is making our this list of highest currencies in the world.The currency exists in bank notes (1/4, 1/2 1, 5, 10, 20 Dinars) and in coins (5, 10, 25, 50, 100 and 500 Fils). The currency is issued by the central bank of Bahrain and it is equivalent to ₦959.01 in Nigerian Naira and 2.65 US Dollars.

3. Omani Rial

This is the official currency of Oman. This currency is available in bank notes (200 Baisa,10 rials, 5 rials,1 rial, 20 rials, 50 rials, ½ rials, 100 Baisa) and in coins (25 Baisa, 10 Baisa, 100 Baisa, 50 Baisa and 5 Baisa). One Omani rial equals to ₦939.03 in Nigerian Naira and 2.60 United States Dollars.

This is the official currency of jordan since 1950 is the fourth highest valued currency in the world this currency is available in bank notes (1, 5, 10, 20, 50 Dinars) and in coins (1/2, 1, 2½, 5, 10, 1/4, 1/2 Piastres/Qirsh). One Jordanian Dinar equals to ₦509.95 in Nigerian Naira and $1.41 in United States Dollars.

5. British Pound Sterling

This is the currency of the U.K, Jersey and other closely related states. Its symbol is £. This currency is the fifth highest valued currency in the world. It is available in Bank notes (£1, £5, £10, £20, £50, £100) and in coins (1pence, 2p, 5p, 10p, 20p, and so on.) It is issued by the Bank of England and 1 euro equals to $1-30 US Dollars.

6. Cayman islands Dollar.

This is the official currency of the Cayman islands. One Cayman islands Dollar equals to 434.05 Naira and 1.20 US Dollars. The symbol for this currency is $ or CI$. It is available in 1,5,10,25,50,100 dollars for the bank notes. And in coins it is 1, 5, 10, 25 cents. This currency is issued by the Cayman islands monetary authority.

7. European Euro

19 out of 28 members of the European Union use this currency. Its symbol is €. The currency is issued by European Central Bank and it has different printers. It is available both in coins (1 cent, 2, 5, 10, 20, and 50 cents) and in bank notes (€5, 10, 20, 50, 100). One European Euro equals to ₦411.39 in Nigerian Naira and $1.14 in United States Dollars.

8. Swiss Franc.

This is the official currency of Switzerland and Liechtenstein. The currency is issued by the Swiss National Bank and is available in bank notes (10, 20, 50, 100, 200, 1,000 Francs) and in coins. One Swiss Franc equals to ₦361.15 Naira and $1.00 US Dollar. It is also used in Italy and an unofficial user is Germany too.

9. US Dollars

Who doesn’t know of the US Dollar? This currency is of course used in the United States and is the ninth highest currency in the world. The Bank notes are $1, 5, 10, 20, 50, and $100. It is also available in coins which is cents (1c, 5c, 10c, 25c, and 50 cents). One United States Dollar equals to ₦361.50 in Nigerian Naira. The symbol of the Dollar is $.

10. Canadian Dollar

This is the currency of Canada. Its symbol is also $. This currency is issued by the Bank of Canada and is available in both bank notes ($5, $10, $20, $50 and $100) and in coins (5 cents, 10c, and 25c). One Canadian Dollar equals to ₦274.09 Nigerian Naira and 0.76 US Dollars. Canada is a North American country located close to the U.S.

Conclusion

The list above represents the highest currencies in the world for 2018 to date, should we have additional information or any other list of highest currencies to add, it will be included accordingly. We believe you have learned exactly what you were looking for. All the currency conversions are of February 2019. They could change later in the future. So, above are the ten highest currencies in the world.